In the past two months, e-cigarette policies in various countries worldwide have been introduced one after another, providing more guarantees and stable development conditions for the regulation of the e-cigarette industry.

Before December 2, 2021, e-cigarettes have been controversial in China, and the media’s attitude towards e-cigarettes is not favorable. Just after introducing the e-cigarette policy on December 2, the e-cigarette was included in the control scope of the China Tobacco Bureau. After the management of e-cigarettes began to be sorted out, the e-cigarette was marked with a new label. All publicity is good news for e-cigarettes. For example, it helps to quit smoking. For instance, its harm to the human body is more than 95% lower than traditional tobacco. Coupled with management agreements on raw materials and production, the status of electronic cigarettes in the Chinese market has been established.

Coincidentally, as the world’s largest smoker country, China’s redefinition of electronic cigarettes has also made other countries follow suit and sort out local electronic cigarette policies. This allows e-cigarettes to gain more recognition in the global market, at least in the future development, and it is awe-inspiring.

Let us sort out the countries that have made new regulations for the development of electronic cigarettes in the past two months:

1. China has opened the application window for the “Tobacco Monopoly Production License” since May 5 and emphasized that the necessary conditions stipulated by China can only be eligible for application. After October 1, the sale of flavored electronic cigarette products within the scope specified by the China Tobacco Administration will be prohibited.

2. Amended order by District Judge Paul Grimm of the U.S. District Court for the District of Maryland, the FDA must provide a PMTA status report for premarket tobacco product applications every 90 days. The first report will be released on April 29. In addition, the Portland City Council unanimously approved a ban on the sale of flavored tobacco products, which will go into effect on June 1.

3. Germany passed the Tobacco Tax Modernization Act on July 9, 2021, which will add additional taxes to e-liquids. The tax starts at 0.16 euros per milliliter on July 1, 2022, and increases until it reaches 0.32 euros per milliliter on January 1, 2026.

4. Indonesia has designated July 18 as the “Indonesian Electronic Atomization Festival.” Imported electronic atomization must obtain a recommendation letter from the Indonesian Ministry of Health, the Indonesian Food and Drug Administration, the Indonesian Ministry of Industry, and the Indonesian National Standard Certification before being sold in the Indonesian market. (SNI). The tax rate on the retail price of vaping products is 57%. All nicotine-containing liquids are considered “other processed tobacco” or products containing “tobacco extracts and flavors”; electronic vaping products host, atomizers, and nicotine-free drinks are considered consumer products.

5. The Philippines classifies electronic atomization products as pharmaceutical products and medical devices and regards them as “harm reduction auxiliary products.” Therefore, all businesses involved in the manufacture, distribution, import, marketing, and sale of vaping products must obtain a License to Operate (LTO) from the Food and Drug Administration (FDA).

Vaping products must be safe for children, and sales to minors are prohibited. Banned in public places and restricted its use in public transport. Use in public places in the Philippines faces up to four months in prison. Proposed Vaping Bill: Set to take effect in May 2022, removes restrictions on flavors and online advertising “should not compromise quit vaping messages, nor should it encourage non-vaping grass or non-nicotine users to use vaping. The proposed measures also allow for the advertisement and promotion of products such as vaping and HTP at the point of sale, direct marketing, and the Internet.

6. Malaysia prohibits the sale, distribution, or importation of nicotine-containing vaping products on the market and can only be sold by licensed pharmacies or registered doctors. Furthermore, all vaping products are subject to a 10% tax on the retail price and a specific tax of RM0.4 per millimeter of liquid. In addition, local manufacturers and importers of vaping products must apply for SIRIM certification and marking. The ordinance will take effect on August 3, 2022.

7. The Alaska Senate passed a bill that would raise the legal age for buying and selling tobacco products from 19 to 21 and would tax vaping products statewide at 45 percent of the wholesale price, regardless of including FDA-approved smoking cessation devices. The bill is currently under review in the House of Representatives and will reach a conclusion by May 18.

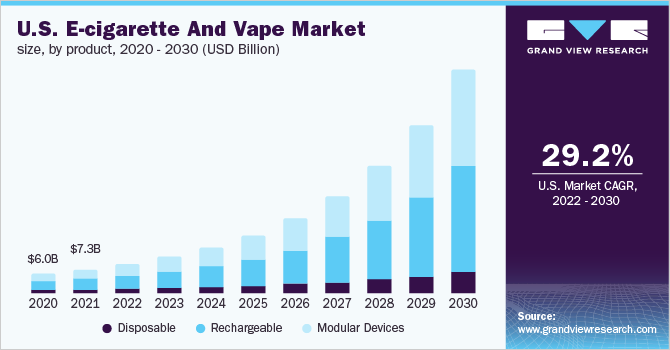

We can also clearly know that the development trend of electronic cigarettes will be unstoppable through the above policies. According to the statistics of Grandview Research, the global electronic atomization market will be 18.1 billion U.S. dollars in 2021, of which countries with market size of more than 1 billion U.S. dollars include the United States, the United Kingdom, As well as Canada, the U.S. market size is $7.3 billion. In the United States, vaping products are the second most used tobacco product and have a high user penetration rate. Market research firm GIA released a research report in March this year, showing that the U.S. market is expected to be $5.3 billion in 2022, and by 2028, the U.S. vaping market is expected to reach $40.25 billion. Grandview Research expects the U.S. vaping market to get a CAGR of 30.0% from 2022 to 2030.

Following the standardization of e-cigarettes in other countries, the market growth has also increased year by year. Although electronics started in 2003 with Chinese pharmacist Han Li, it has been 19 years since then. But its market size is not fully saturated, and it is in an explosive state. At that time, when the annual sales were 1 billion, people thought it was incredible. When the yearly sales are tens of billions of dollars, people’s views are different. Because the times are progressing, the attitudes of the leading consumer groups and the country are changing. Although the development of the e-cigarette industry has been controversial and the policies of various countries are not friendly to it, it has proved its value and significance with time.

Now more and more countries worldwide are formulating open policies for the development of electronic cigarettes, which undoubtedly gives electronic cigarettes wings and makes electronic cigarettes fly higher and farther.